A Question of Value

In 2016, we surveyed a number of our clients on a variety of topics. One of the “questions” related to understanding the level of our clients’ perceived value in working with us was: “I receive good value for the fees I pay” – a question that seemed pretty straightforward as we were selecting from the alternatives our consulting firm provided.

However, upon further consideration, we have come to realize that the concept of perceived value is easy to define, but difficult to measure. In order to do so, we also need to know which benefits are being considered and how their value is being measured.

We constantly strive to provide the most value possible to our clients. Our strategy is simple: provide better, more comprehensive services to our clients at more competitive rates than other firms offer.

While the fees we charge are referred to as investment advisory fees in the majority of cases, they almost always cover all of our advisory and financial planning services. These include not only investment management, but many other areas such as long-term wealth accumulation planning, retirement income and distribution planning, insurance planning, estate planning and the coordination, integration and implementation of planning strategies – all of which we believe add significant value beyond investment management even though quantifying the potential economic impact is difficult.

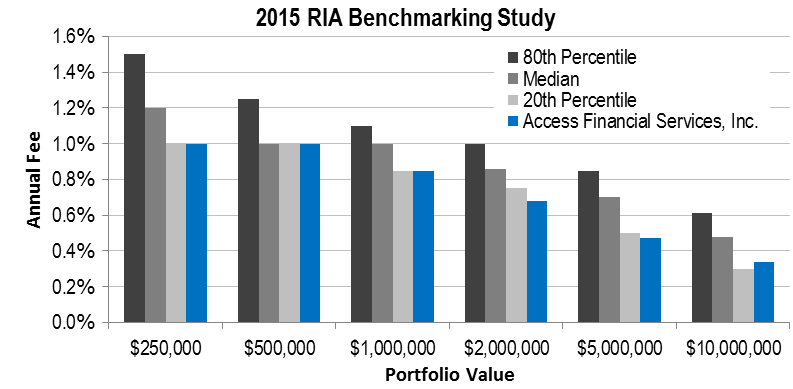

From the perspective of cost, our investment advisory fees are low by industry standards. In fact, others in the industry often advise us to raise our fees. Below is a graph illustrating our fee schedule relative to other similar firms using data from the 2015 Schwab RIA Benchmarking Study for advisers with assets under management between $100 million and $250 million.

A simple definition of value is: a measure of the benefit gained from goods or services. We strive to be valuable to our clients by providing comprehensive, customized and integrated financial planning that covers a broad spectrum of topics. While it is a standard practice within our industry to use a single “investment advisory fee” as a means of charging for financial planning, we hope you agree that it understates the scope of the work we do (click diagram).